In a surprising twist of fate, the remarkable achievement of 16-year-old darts sensation Luke Littler at the World Darts Championship has been overshadowed by a heated discussion about his substantial tax liabilities. Littler’s incredible performance landed him a runner-up position and a prize of £200,000. However, it was soon revealed that a significant portion of his winnings would go to the tax authorities, sparking a wider debate on taxation, youth in sports, and the role of public communication by tax authorities.

Understanding the Tax Situation

Littler’s second-place victory was not just a personal triumph but also a significant financial windfall. However, the reality of taxation soon set in. With reports indicating that he will lose 45% of his £200,000 winnings to taxes, the young athlete faces a substantial reduction in his prize money. The breakdown includes a hefty slice for income tax and national insurance contributions.

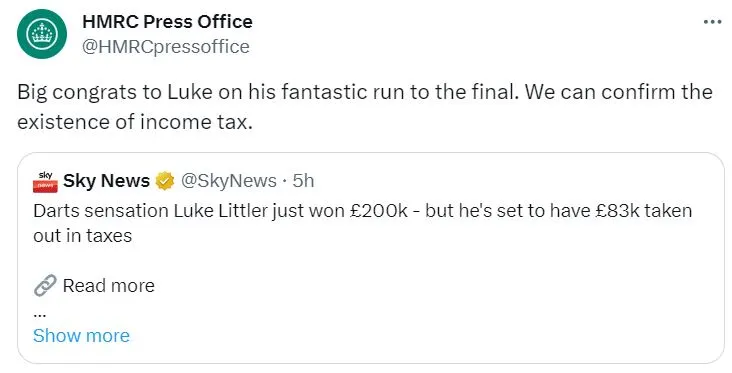

Public Reaction to HMRC’s Communication

The tax situation took a more controversial turn when HMRC’s press office posted a tweet that many fans deemed ‘brutal’ and ‘inappropriate.’ The tweet, while confirming the existence of income tax, was criticized for its tone and timing, especially considering Littler’s age and the nature of his achievement. Fans and commentators quickly voiced their displeasure, pointing out that the communication seemed to lack sensitivity and could discourage young talents.

Lessons and Advice for Young Athletes

Littler’s situation is a stark reminder of the financial realities facing young athletes who achieve sudden success. Financial expert Andrew Mangion’s advice highlights the importance of professional financial guidance for young stars. Here are several lessons and pieces of advice for young athletes facing similar situations:

- Understand Your Tax Obligations: Knowledge is power. Understanding how earnings from sports achievements are taxed is crucial for young athletes and their families.

- Seek Professional Advice: It’s advisable for young athletes who come into substantial money to seek financial and tax advice to manage their earnings effectively and plan for the future.

- Be Prepared for Public Scrutiny: High earnings can lead to public and media attention. Young stars should be prepared to handle this aspect professionally and with the support of their team.

Conclusion

The case of Luke Littler is more than a story about a young talent facing a hefty tax bill; it’s a conversation starter about how young athletes are supported and treated in the public eye. While taxes are an unavoidable aspect of earning, the way in which tax authorities and the public respond to these situations can significantly impact the encouragement and development of young talents. As we celebrate the achievements of young prodigies like Littler, it’s also important to navigate the complexities of their success with understanding and support.